Global

The global market volume of paint and coatings amounted to nearly ten billion gallons in 2019. In 2020, the global paint and coatings industry was estimated to be valued at some 158 billion dollars.

USA

The U.S. paints and coatings market size was valued at USD 24.2 billion in 2019 and is expected to grow at a compound annual growth rate (CAGR) of 3.7% from 2020 to 2027

The architectural and decorative segment led the market and accounted for more than 57.0% share of the overall revenue in 2019. Rising infrastructure spending in the U.S. is expected to potentially fuel the growth of the construction industry over the forecast period.

The acrylic segment led the market and accounted for more than 42.0% share of the overall revenue in 2019. This is attributed to its high demand from infrastructure, automotive, paints and varnishes, and paints and metal coating applications.

China

Since 2013, Chinese total paint production has accounted for more than one-third of the world's total production.

The biggest companies in the Paint Manufacturing industry are in China. The companies holding the largest market share in the Paint Manufacturing in China industry include Nippon Paint (China) Co., Ltd., Akzo Nobel Coatings (China), PPG Paints (China) Co., Ltd., Chugoku Marine Paints (China), and Axalta Coating Systems China.

Between 2011 and 2020, the market value of the Chinese paint manufacturing industry had year-on-year growth, peaking in 2020 at 87.5 billion U.S. dollars. The market value of paint manufacturing in China is estimated to grow further during 2021, to 91.7 billion U.S. dollars

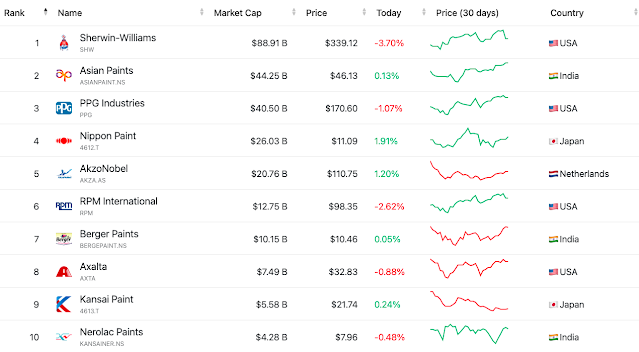

Market Cap based comparison-World

companies: 10 total market cap: $260.75 B time:as of January 2022For more than 20 years, the coatings industry has been undergoing a change from “solvent-borne” to “waterborne”. The main drivers for this change include increased general awareness on health and the environment to reduce carbon footprint.

INDIA

The Indian paint industry was the second largest in the APAC region in 2020. The sector witnessed significant growth over the past few years. In 2019, the. In 2019, the trade value of the country's paint industry was over 57 trillion Indian rupees

Market Share Comparison

- Porter's Five forces

Future Prospects

- Many paint companies have been entering into the waterproofing and construction chemicals space in the past few years. The Indian waterproofing market, valued at US$ 0.7 billion is fairly underutilized compared to China’s US$ 22bn markets. Thus, there is a lot of headroom to grow in this segment in the next 15-20 years

- Growing demand from the construction industry, coupled with rising infrastructure activities, is driving the demand for the market studied.

- Decreasing automotive production and sales in the country are estimated to hamper the growth of the market studied.

- The use of nanotechnology in the paints and coatings industry is expected to offer various opportunities for the growth of the market studied during the forecast period.

Industry level comparison

With a 57% market share among the listed companies, Asian Paints has the highest profit margins. Followed by Berger and Nerolac.

Asian paints P/E and P/S are more than the average showing the share is a bit overvalued. On the other hand, Nerolac is below the average, showing the potential for future upside.

Asset turnover and Inventory turnover measures how much times turnover is in comparison to assets and inventory respectively. A higher number indicates the company is utilizing capital efficiently. Making more revenue with lower investment in assets and inventory.

Here we see Asian Paints is leading in Inventory Turnover while Berger in asset turnover.

So, we take Asian Paints and Berger as comparables.

Company Level Comparison

Asian Paints

Quarterly Sales have increased by 27% in Quarter ending September. Gross margins and net margins have reduced to 13% and 12% respectively. The company has raised around 300 crores in debt. Investments were reduced by around 2000 crore. Investment in working capital increased by 2000 crore.

At a P/E of 90, the share is expected to range around 3069 by year-end.

Berger Paints

Quarterly Sales have increased by 24% in Quarter ending September. Gross and Net Margins range near company average to 16% and 13% respectively. The company has raised around 400 crores. The same is invested in working capital.

At a P/E of 86, the share is expected to range around 746 by year-end

Post with detailed company level comparison to follow

Good Analysis! Indigo Paints may also be considered in the comparison. It is a growing company, with good potential.

ReplyDelete